Everything posted by DarkandStormy

-

Electric Cars

https://www.cnet.com/roadshow/news/best-ev-electric-car/ I think some Tesla fans aren't happy with this list.

-

Electric Cars

Biden (or the Biden Administration) released a "strongly worded" letter condemning the USPS contract with Oskhosh which sort of begs the question...why doesn't Biden just fire Dejoy and appoint someone who will enact the EPA recommendation as Postmaster General? It's very bizarre. To be fair, I don't know exactly about the Postmaster General process and I seem to remember there being a board or something that has to approve it. So it might not be as easy as "nominate Kanye West" and get him approved by a majority of the Senate.

-

NFL: General News & Discussion

- Blockchains and Cryptocurriences

We live in the dumbest timeline.- Columbus: General Business & Economic News

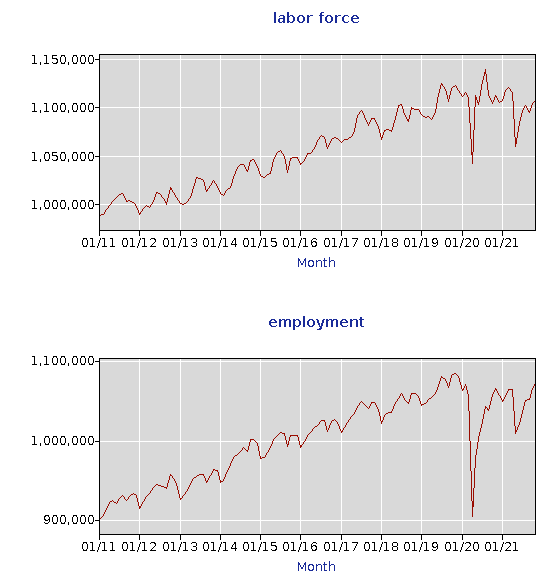

This is good news, but the labor force is still down in total. So depending on which rate was used to calculate the 2.8%, it may not be capturing the entire picture. Here's for the metro area: But things are certainly trending in the right direction. With all of the covid deaths (or just excess deaths) and layering on population gains, it's hard to get an accurate picture of the total labor force eligible population. How many people are aged ~15-62 but simply out of work and not looking for a job (which means they wouldn't get picked up in the unemployment rate if they use U6 - I think)? As has been discussed ad nauseum, the economy in Columbus is set up in such a way that it's able to recover more quickly from downturns. There are a pretty steady stream of articles about more job openings than people available in the area.- New Albany: Ohio One (Intel Semiconductor Facility)

DarkandStormy replied to cbussoccer's post in a topic in Central & Southeast Ohio Projects & ConstructionHaaaaave you heard of Foxconn?- New Albany: Ohio One (Intel Semiconductor Facility)

DarkandStormy replied to cbussoccer's post in a topic in Central & Southeast Ohio Projects & Construction$2 billion in incentives.- MLB: General News & Discussion

David Ortiz made the HoF, which means steroid usage doesn't matter anymore. A lot more guys should be in now, right?- Columbus Brewery / Beer / Alcohol News

https://www.bbc.com/news/uk-scotland-59957485 Brewdog chief James Watt accused of inappropriate behaviour So far, the response from Watt via his layers is that every single allegation is false. The manager (I assume former, now) at the Franklinton bar seems like a really stand up guy in the piece.- Columbus: General Business & Economic News

I'm not sure what's proprietary or new about Root's model...which they claim comes from tracking one's driving via an app and then assigning you a premium based on your driving habits. Almost all of the big companies in the industry offer this, whether it's through an app or a device you plug in your car. There's nothing new - from what I can tell - about what Root is offering. On top of that, there were plenty of anecdotes from people who had an "introductory" rate for 3 or 6 months, only to have their premiums rise without notice after that. If that's their model, alienating your customer base is not a good way to sustain your insured base. I'm not entirely sure. Root could have overestimated the "work from home" effect in March-May 2020. That is, there were not very many miles driven in that time, so they likely lowered premiums based on risk dropping. But pretty quickly thereafter, miles driven rebounded to more "normal" levels and I believe 2021 ended up very near where 2019 was. Root wouldn't have been the only ones to have done this if they did. As for the results of other companies, most 2021 financials won't be out until next month. I'm also not sure which insurers break out auto insurance and which ones don't (to my knowledge, Root only offers auto insurance, most other insurance companies add on life, home, etc.). All State: 2020 - ~$45bn revenue, $5.5bn net income / TTM (so 9/30/20-9/30/21) - ~$51bn revenue, $3.3bn net income Progressive: 2020 - ~$43bn revenue, $5.7bn net income / TTM - ~$46bn revenue, $4bn net income Just for a couple examples. But again, without knowing the breakout of auto, home, life, etc. it's hard to get an apples to apples comparison to Root. If All State, Progressive, and others have seen an uptick in life insurance payouts (due to covid - and we know excess deaths are up about 1m in the last two years), then it's possible their auto business stayed steady. Other factors might be over estimating the "work from home" effect in early 2020, supply chain issues for repairs increasing the cost of claims, and probably others I'm missing.- Columbus: General Business & Economic News

Their stock price is down 87% in the last year. Their earnings will be very interesting next month.- Columbus: General Business & Economic News

Root Insurance laid off 20% of its workforce today. https://www.bizjournals.com/columbus/inno/stories/news/2022/01/20/root-insurance-330-jobs-cut-covid-19.html- Personal Finance / Investing Thread

- Ohio Congressional Redistricting / Gerrymandering

- Personal Finance / Investing Thread

You're basically describing "the wheel" strategy, yes? I.e., if you were assigned the stocks from a put you sold, you'd then quickly sell covered calls?- Personal Finance / Investing Thread

I did a "total portfolio" change, not a true ROI. So that includes contributions in there.- Personal Finance / Investing Thread

Update: -2021: +20% (vs S&P 500 +27%) -2020: +32.5% (vs S&P 500 +18.4%) -2019: +31.7% (vs S&P 500 +31.49%) -2018: -2.5% (vs S&P 500 -4.38%) -2017: +23.8% (vs S&P 500 + 21.83%) S&P 500 returns may vary depending on how dividends are treated, among other factors. Looks like my streak of beating SPY will come to an end. Not as great of a year (comparatively) for tech stocks, plus I reduced some exposure. It's still wild to look back and see that my portfolio is up ~520% from five years ago. The corona crash looks like a blip now, barely.- Columbus Blue Jackets Discussion

Oliver Bjorkstrand has entered the protocol.- Ohio Ski Resorts

https://triblive.com/local/regional/seven-springs-sale-to-vail-resorts-seen-as-possible-boost-to-tourism/ 7 Springs was recently acquired by Vail.- Personal Finance / Investing Thread

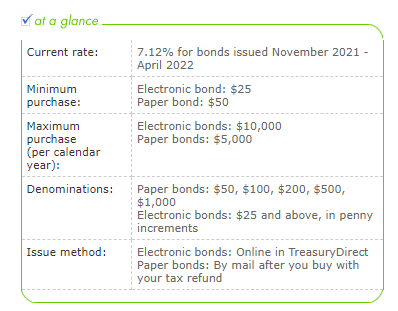

https://www.treasurydirect.gov/indiv/products/prod_ibonds_glance.htm Just a heads up, federal i bonds rate now have an interest rate of 7.12%. You can't buy through a private brokerage - you have to go through TreasuryDirect. Each person can buy up to $10,000/year (plus $5k more with your tax refund). You do have to own it for at least one year and it will earn interest for 30 years, but after that initial year you can withdraw at any time. If you withdraw before five years is up, you would forfeit the interest from the previous 3 months. There's also a semiannual adjustment for inflation. 7.12% is the second-highest initial rate in history. Just an FYI in case you wanted a risk-free place to park some long term cash. If you know you won't be touching that money for awhile, it's a pretty good rate. Much better than a savings account or C.D. There are some tax benefits as well if you end up using the bonds to pay for college - I'm not sure of all the ins and outs of that, so research that more if you think you'd do that. Some other things as well around gifting and such.- Columbus: Crime & Safety Discussion

Shout-out to everyone who bought the "crime is raging" narrative and then spread it without evidence.- Housing Market & Trends

https://markets.businessinsider.com/news/commodities/lumber-prices-above-1000-first-time-since-june-housing-commodities-2021-12 Lumber booming again.- Columbus: German Village / Schumacher Place Developments and News

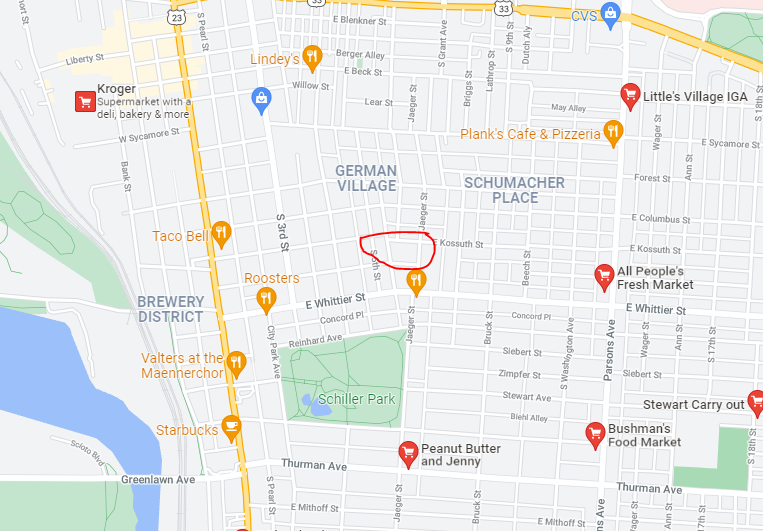

DarkandStormy replied to buildingcincinnati's post in a topic in Central & Southeast Ohio Projects & ConstructionMy guess is a bunch of people in the area enjoyed walking to that location for a quick grocery stop and they don't want to walk across High Street to Kroger or (*gasp*) go near Parsons to the IGA. It was one of two "safe" grocery locations south of downtown, if I have the language correct (tongue firmly in cheek).- Columbus: OSU / University Area Developments and News

DarkandStormy replied to CMH_Downtown's post in a topic in Central & Southeast Ohio Projects & ConstructionUnrelated, but the Freakonomics podcast had a good episode on Trader Joe's a few years back. They briefly went into how Trader Joe's picked locations...or rather, if there was causation (or merely a correlation) between where they picked locations for stores and the near-term impact it had on real estate prices in the area. (They also covered the history/founding of the store, what makes them different, how they don't use algorithms to track your spending and target you with ads/coupons, etc.)- Ohio Congressional Redistricting / Gerrymandering

https://ohiocapitaljournal.com/2021/12/06/ohio-lawmakers-hire-lawyers-who-defended-largest-racial-gerrymanders-ever-encountered/ Oh, good. - Blockchains and Cryptocurriences