Everything posted by DarkandStormy

-

Personal Finance / Investing Thread

I was talking about their reported revenue - down slightly YoY but much better than compared to the rest of the industry. I'd have to take a deeper look at other "luxury brands" to see how they've held up in 2020. Other staples are doing well - Walmart, Target, Dollar General, etc. So it's hard to pinpoint a trend of luxury vs. mainstream/lower end brands off of just the few examples I listed. But with less traveling and bars shut down, I could see people buying more beer to drink at home and some might want to "treat themselves" with a higher end beer (Sams is the 4th-largest brewery in the U.S. so it's hard to call them "craft"). As for Tesla, I anticipate the accounting gimmicks will dry up soon and they'll go back to being a loss company. They've reportedly delayed rent on their NY factory. The regulatory credits you mentioned are anticipated to drop significantly the 2nd half of 2020. And the sales on their higher margin models (S and X) have slowed way down in favor of the more "affordable" models (3 and Y), which they make less margin on. On top of that, there are many, many anecdotal reports of terrible build quality in the new Model Y and Tesla has been slow to re-open service centers, despite selling more and more vehicles. Elon also continues to exaggerate (mislead? lie? if you're a skeptic) the claims about "autonomy." The deadline, of course, continues to get pushed back. I'm of the mind that they did everything they could to post four straight quarters of "profitability" for S&P 500 inclusion. They are now the 12th-largest company by market size. But many issues remain long term, including build quality (as evidenced by ranking last in initial quality by JD Power survey). They are trying to expand rapidly (Shanghai factory expanding, Berlin factory started I believe?, and the recent announcement of another U.S. factory near Austin...which, of course, included tax abatements or whatever) while competitors are catching up - notably VW. I think the "technology lead" Tesla fans spout is shrinking, but they don't want to admit it.

-

NHL: General News & Discussion

I like it. They already have an official Rum sponsor (Kraken). It's also a bit more mysterious/ominous than the Sockeye(s). https://www.espn.com/nhl/story/_/id/29520108/how-seattle-nhl-team-became-kraken Apparently, the urban myth is that the idea started in 2018 with a hand-written post-it note on the team door. I'm sure *someone* came up with the idea, but no one is stepping forward so far. Other names considered: -Metropolitans (shut down by the NHL because of the currently-named Metropolitan Division) -Sockeyes -Totems -Breakers -Renegades Given Seattle team names currently (Mariners, Seahawks, Sounders) I think Kraken works the best.

-

Personal Finance / Investing Thread

SAM crushed earnings yesterday. Stock is up 18% today even though markets are down overall. Luxury brands still do well in down economies it would seem (see also: TSLA).

-

Personal Finance / Investing Thread

It's up 83% YTD who cares about a dividend lol

-

Personal Finance / Investing Thread

Tesla posted a profit for the 4th consecutive quarter and is now eligible for the S&P 500.

-

Ohio House Speaker

He and his aides were under investigation then but no charges were ever filed and the case was closed in 2006. I believe so. He's also been ordered to remove all guns from his property by 5 pm today.

-

Ohio House Speaker

When your state party is so corrupt you can't keep track of your arrested Speakers. Never forget - then-AG Mike DeWine tipped off Rosenberger about the FBI probe days before his eventual resignation.

-

Ohio House Speaker

Householder is also charged with racketeering, btw.

-

Ohio House Speaker

Here's a quick summary in a paragraph.

-

Ohio House Speaker

Also seeing several others arrested - apparently in connection with last year's House Bill 6 / First Energy Solutions nuke plant bailout.

-

Ohio House Speaker

Cincinnati Enquirer also reporting additional arrest of Matt Borges, former chair of the Ohio Republican Party and longtime Kasich ally who recently helped launch a pro-Biden super PAC.

-

Ohio House Speaker

Next Ohio House Speaker - Niraj Antani or Nino Vitale?

-

Ohio House Speaker

https://www.daytondailynews.com/news/breaking-news-fbi-agents-are-at-ohio-house-speaker-larry-householders-farm/JCKHFEK4ZFH5HJF5O4MCP3BY2M/ Didn't know what thread to put this in but, uh, sounds like the FBI is involved...once again...with the Speaker of the House in Ohio. EDIT - more to the story. Here we go. https://www.cincinnati.com/story/news/2020/07/21/ohio-bribery-case-state-official-charged-federal-prosecutors/5477862002/

-

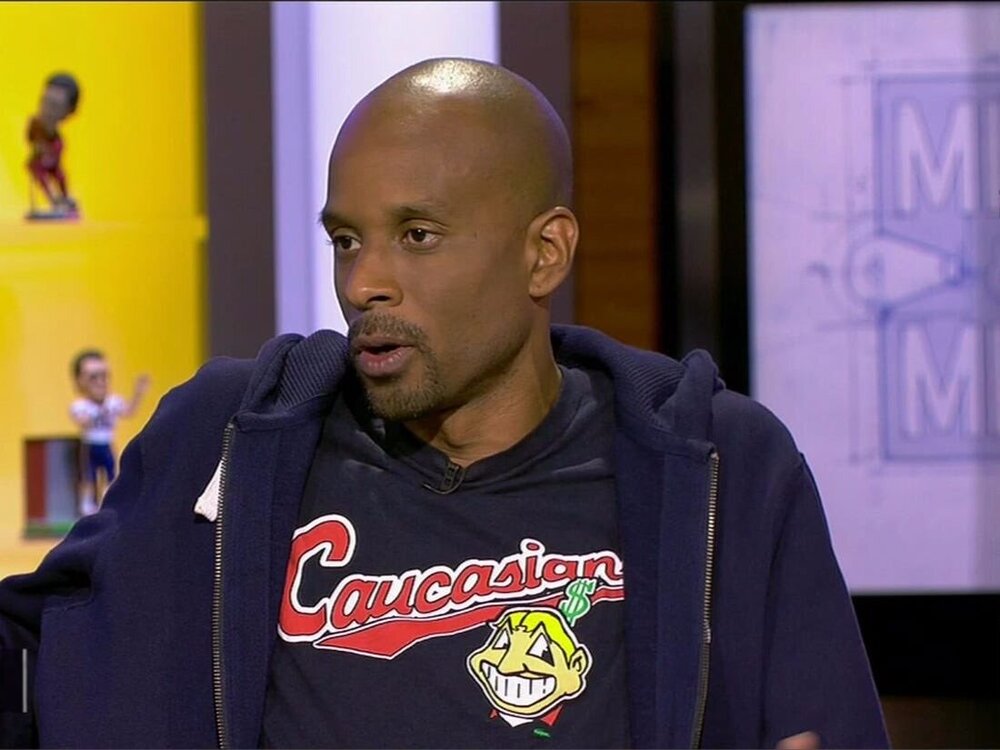

Cleveland Guardians Discussion

"just let us be a little bit racist, please!!!"

-

Personal Finance / Investing Thread

You guys missed the WKHS bandwagon by about a month.

-

Personal Finance / Investing Thread

NASDAQ > S&P

-

Personal Finance / Investing Thread

Tesla's market cap is now something like ~30% of the entire auto industry despite accounting for ~0.4% of sales and 0% of profits.

-

Personal Finance / Investing Thread

Yeah, that's the point of the strip. If I were a financial advisor, I'd get the 401k and IRA set up first so you're consistently getting into pretty consistent index funds. If you're in a position to have "extra" money you want to invest and you think you're Warren Buffett, then have it with ~5% or less of your portfolio. Don't touch the retirement funds until ~5 years out from retirement when we'd then discuss bond allocation.

-

Personal Finance / Investing Thread

This Tesla run has to end, right?

-

The Ohio State University Buckeyes Football Discussion

Folks need to come to terms with sports not happening this fall. Clemson also shut down workouts after 37 tested positive there, plus some staff.

-

Personal Finance / Investing Thread

This notion, as has been discussed, is nearly-entirely a myth and certainly not one that amateurs are able to pull off. Better to just leave retirement funds in the market than to try to constantly time the market. https://imgur.com/gallery/BlK4jzM

-

NFL: General News & Discussion

- Personal Finance / Investing Thread

On the "work/school" from home front...a lot of states seem to be in chaos about their back to school plans this fall. Might it make sense to pick up CHGG? I know it's already up some 160% since its low but seems like their sales are going to keep increasing. I mentioned upthread about anything related to EVs doing incredibly well...TSLA gets a lot of the headlines, but less hyped stocks include FUV, WKHS (mentioned here a bit), SOLO, BLNK, IDEX, NKLA, SHLL, and maybe a few more I'm missing. Some of these are penny stocks. Some of these are TSLA hype without any actual products (NKLA). Some have started producing vehicles in various spaces - consumer cars, commercial trucks, golf cart/motorcycle types, etc. FUV - seems interesting. High MSRP when you compare to a base model Yaris or other lower end compact vehicles. They picked up Sandy Munroe, who some think is one of the better minds in the EV space. Potentially some golf cart market interest? Otherwise, it's a glorified motorcycle on three wheels and there are some questions around drivers needing to get a motorcycle permit for a three-wheeled, open air vehicle. WKHS - already discussed in this thread a bit. More in the commercial space with some impressive partners/contracts already lined up. SOLO - up some 240% since earlier this year. I don't believe they're in production yet? But the Solo looks like it'll compete with Arciomoto's (FUV) Fun Utility Vehicle. The specs on their other concept vehicles look paltry compared to Teslas, Porsche Taycan, etc. BLNK - network of EV charging stations; unclear to me how it stacks up with Electrify America or any number of other ones out there. Price per kwh seems very high compared to Tesla's Superchargers (nearly 3x as high with a longer charging time required). So...I don't fully get the hype here. IDEX - know very little NKLA - for now, seems like a total scam. The CEO is trying to out Elon Elon. That's a tall order. They have no production vehicles - just a semi prototype - and no factory yet to build their concept vehicles. The deposits on the pickup become *NON REFUNDABLE* before the vehicle is even unveiled. A lot of gimmicks have gone into the preorders this week (selling raffle tickets for a free vehicle depending on your deposit amount, for example). They're also mixing BEV and FCEV tech which seems...odd. They're going to need to build a ton of hydrogen stations if they want to scale. To me, this has Theranos written all over it as of now. SHLL - this is essentially VTIQ (VectoIQ) before they merged with Nikola via an SPAC. It's essentially a blank check corporation that is public with the purposes of seeking a company to acquire. The company in this case is Hyliion, which specializes in hybrid and electric powertrains for commercial trucks - the leader in Class 8 at the moment. They do actually have products, though I'm a bit unfamiliar with their claim that they will recycle natural gas as part of a new power train. Still...they have a record in sales and could beat both TSLA and NKLA to the punch in commercial trucking. All of these stocks are up massively in the last few months. I do believe we will be transitioning to more electric vehicles, so the growth is there in this space. It's just a matter of picking out a few winners and not falling for the scams/losers.- Personal Finance / Investing Thread

Congrats to all the TSLA and WKHS stock holders lol- Electric Cars

Toyota actually produced 21x more vehicles than Tesla in 2019. - Personal Finance / Investing Thread