Everything posted by DarkandStormy

-

Personal Finance / Investing Thread

JPow giveth...and JPow taketh away. EDIT - nvm, JPow still giveth

-

Personal Finance / Investing Thread

Anything remotely related to EVs is doing well - TSLA, WKHS, NKLA, FUV, BLNK.

-

Greater Columbus COTA News & Discussion

^The cashless program would seem to negatively impact poorer people, wouldn't it? Not everyone has a smart phone, crazy as that sounds. So if you don't have a smartphone or don't have a credit card (not everyone has a credit or even debit card) to load funds onto the smartphone app...you have to pre-plan your trips with cards loaded with funds. And if you're an out of town visitor you either have to download a new app and load funds or go to a location that sells one of these pre-loaded cards instead of just paying with cash/change.

-

Personal Finance / Investing Thread

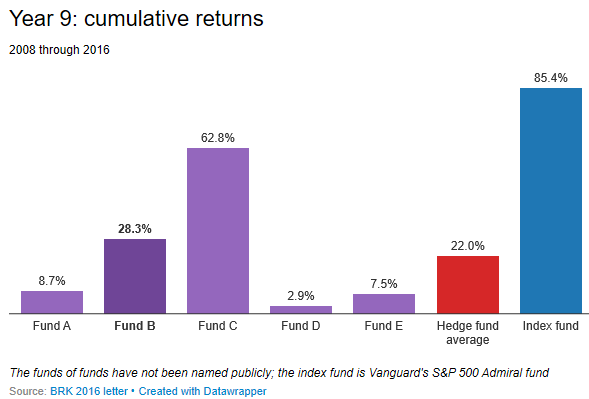

It's always been like this. The "I invested in NFLX @$10 and held to the top!" stories are rare. It's also why active fund managers - nearly 90% - end up losing vs. the broad market over any 5-10 year period.

-

US Economy: News & Discussion

Q1 included two months with no impact of shutdowns/quarantines. April-June activity is likely to be suppressed even more.

-

US Economy: News & Discussion

https://www.cnbc.com/2020/06/25/us-gdp-q1-2020-final-reading.html

-

Governor Mike DeWine

- What are you watching?

How did you get 3 months?? lol Chernobyl recently was really good, in addition to the ones ColDayMan laid out. I'd hesitate a bit on GoT since it's so many seasons, not current, and the ending was...eh, controversial. Other ones we've liked/have been recommended to us: -The Leftovers -McMillions -Westworld -True Detective -Sharp Objects -Deadwood -Succession- Licking County: Developments and News

DarkandStormy replied to buildingcincinnati's post in a topic in Central & Southeast Ohio Projects & Constructionhttps://www.dispatch.com/news/20200622/licking-county-neighbors-block-disabled-youth-group-homes- NHL: General News & Discussion

At least eleven players have tested positive (as of the end of last week). Not sure this is going to go as smoothly as they think.- Personal Finance / Investing Thread

My small cap growth fund (VBK) is up 54% in the last 90 days. MGK (Mega cap) is up 46% in that same time. S&P500 is up 35%.- Personal Finance / Investing Thread

Do share.- Personal Finance / Investing Thread

The stock market isn't the economy. Plus, JPow is printing money faster than the machines can produce it lol- NBA: General News & Discussion

I get the "seeding games" and possible #8/#9 play-in games, but after that...have they talked about doing all of the series best of 5? That's a really right schedule - basically 45 days to get through three rounds (opening round, conference semis, conference finals). Or will they literally just go every other day and try to condense it all and keep them best of 7s?- Personal Finance / Investing Thread

https://www.forbesindia.com/article/chicago-booth/measuring-chance/34269/1 A small percentage of active fund managers are able to produce results that cover the cost of their fees over time, but good luck picking funds from that small percentage since they're indistinguishable from fund managers who happen to get lucky for a few years and look like they're producing better-than-average results.- Personal Finance / Investing Thread

I haven't bothered with trying to time the market in the last decade. It's turned out fine for my purpose - building enough of a nest egg for retirement. https://www.investopedia.com/articles/investing/030916/buffetts-bet-hedge-funds-year-eight-brka-brkb.asp Warren Buffett offered a challenge to any active manager to try and beat him. He put his money in an S&P500 fund and let it ride for ten years. The fund managers could do whatever they wanted over those ten years, but had to be net of their fees. And I believe this bet started Jan 1, 2008 - so Buffett had a very bumpy Year 1. Jack Bogle, founder of Vanguard, on market timing: Worrying about timing the market - a feat that is virtually impossible - will cause you to lose more than if you just invest regularly.- Personal Finance / Investing Thread

If you just invest regularly in market-index funds (or similar) you end up beating actively managed funds over 10+ years.- Personal Finance / Investing Thread

"Buy low, sell high" is what rich people who don't manage their own investments say, but it has virtually no meaning. The saying - if executed properly - means you need to time the market correctly. Twice. It's virtually impossible. Most professionals even fail it. Using this advice, you should have been selling from 2012 on since the markets have been at all-time highs since then. One tell about this sell-off was VIX (Volatility Index). It was rising the past week while the markets kept going up. That's usually a recipe for a big sell off, which is what we saw today.- Personal Finance / Investing Thread

Well, so much for that market rally.- Personal Finance / Investing Thread

Up bigly on a "leaked" email that Elon wants to start production of a vehicle they unveiled in 2017 and with no actual timetable given or factory site to do said production is peak Tesla.- Personal Finance / Investing Thread

^Nikola just recently IPO'd last week, though they had been partially available to invest in publicly via VTIQ (also doing well, but nothing like NKLA so far - Nikola appears to be enjoying a Tesla-like bump). My buddy texted me yesterday morning that he had bought some $50 calls for NKLA, expiring July 2, and was hoping he'd hit. By lunch, the stock price had already surpassed the strike price of the calls. People were asking about options - this is a basic options move. He paid a nominal fee for the right (but not the obligation) to buy NKLA shares at $50/share anytime between the contract executing (yesterday) and July 2. The seller than takes this fee and is hoping the stock price stays below $50 between now and July 2. My friend is now in the money as he can choose to execute the call at the strike price - $50/share. He could immediately sell those shares for a profit since they are up near $80 currently. If the shares had never made it to $50 (well, $50 + call premium - the price paid for the call contract) he would just be out the price paid to execute the call. Hope that was a simple enough explanation on a basic call option.- Personal Finance / Investing Thread

Should have bought Nikola last week.- Columbus: Crime & Safety Discussion

Police make up nearly 1/3 of the city's operating budget. 54 times more spent than on education.- US Economy: News & Discussion

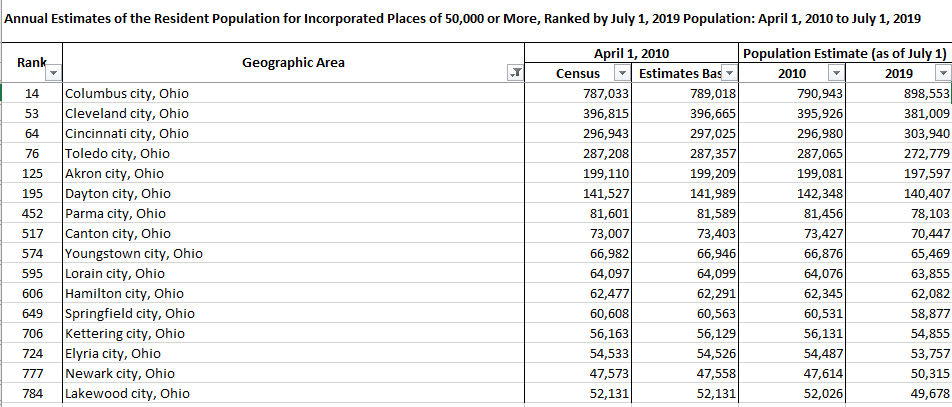

This is Maui. Their entire economy is basically tourism.- Ohio Census / Population Trends & Lists

- What are you watching?