Everything posted by LlamaLawyer

-

Cleveland: Random Development and News

I wish this wasn't called a TIF because it's basically different from all other TIFs. I've got a feeling there will be a lot of reactionary takes from people who don't understand what it is complaining about how it's stealing from the tax base of Cleveland to give a hand out to the Haslams and Gilbert. I still scratch my head at the fact that the General Assembly (which is usually so critical of local control) basically said "yeah, if the city wants to steal property tax from a bunch of county-level agencies, that's great!" I'm pretty optimistic that City of Cleveland will use the money well and so this will all work out nicely for everyone. The bad side is that, you're going to get increased competition between cities, because basically every community is going to look at what Cleveland is doing and say "wait a second, we have to do something like that too or we'll get left behind." So my concern would be what happens if 20 years from now the libraries and tri-c are hurting because they've had basically static revenue for the last 20 years. That could drive significant property tax levies that would artificially raise tax rates across the county and create an eco-system of artificially high property taxes and artificially high infrastructure spending. I know that may sound far fetched given how poor our infrastructure and city services are now, but it is possible to overspend on infrastructure and it is possible to overspend on city services. But, hopefully it all works great. I'm just a little concerned this launches a prisoner's dilemma situation where every city has to pass some huge TIF district and everyone also loses as a result.

-

Cleveland: Random Development and News

https://www.crainscleveland.com/real-estate/blue-abyss-completes-purchase-brook-park-land Well, well, well.* 2024 start targeted. * This is a pun because they're digging a really deep hole and putting water in it.

-

Greater Cleveland Taxation

😂

-

US Economy: News & Discussion

By the way if anybody wants to be a Wikipedia hero (I would, but don't have time this week), the wiki page on GDP by metro is totally screwed up. The numbers are mostly pulled from FRED, and they've got Real GDP and Total GDP mixed in, with some appearing to come from sources other than FRED. It's a mess that ought to be cleaned up. https://en.wikipedia.org/wiki/List_of_U.S._metropolitan_areas_by_GDP

-

Ohio: General Business & Economic News

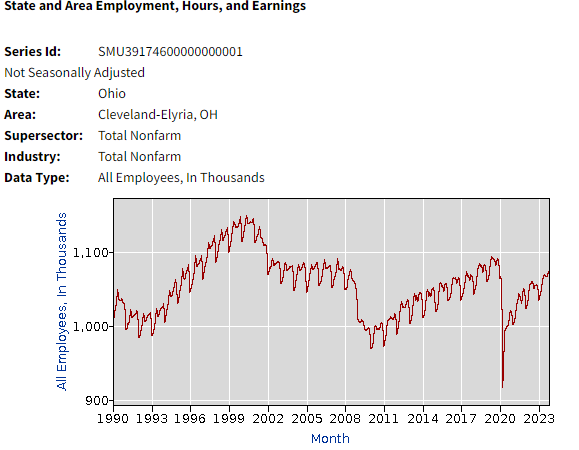

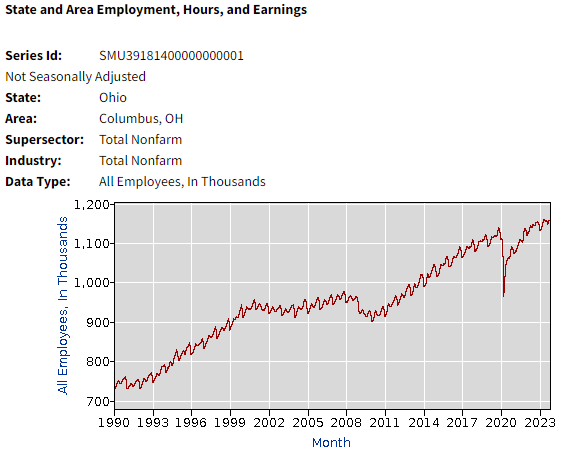

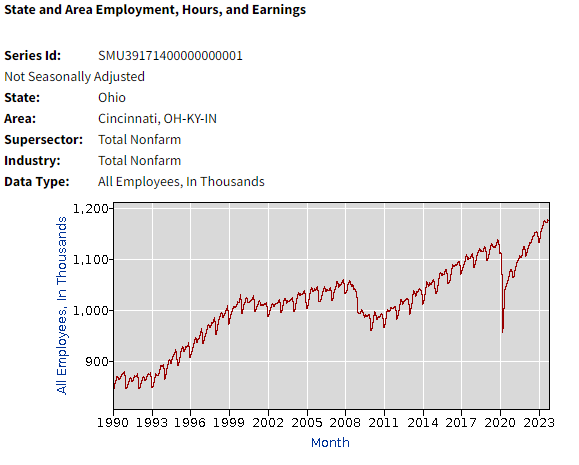

And specifically the Columbus and Cincinnati metros, but I'm pretty optimistic Cleveland will join the ranks soon. (See graphs below). j j

-

Ohio: General Business & Economic News

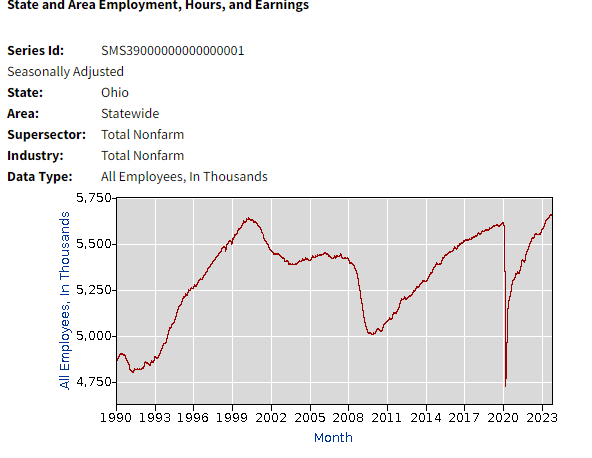

Just wanted to share a little optimistic thought about the state in 2024 This is the chart that shows total nonfarm wage and salary employment from 1990 to present: As shown by the chart and reflected in data tables, employment peaked in mid-2000 at 5.638 million. It surpassed this mark for the first time ever in August of 2023. September, October, and November all surpassed the August number. We don't have data for December yet/January yet, but barring some surprising adjustment, they'll also be above the mid-2000 peak. SO! In 2024, for the first time in more than two decades, we are starting the new year with more jobs than we've ever had before! That's certainly a cause for optimism in my book.

-

Ohio Census / Population Trends & Lists

The interesting outlier in all of this to me is Syria. Cleveland apparently has many Syrian immigrants while Columbus and Cincinnati have few.

-

US Economy: News & Discussion

Well these are lagging indicators. I see a few possibilities. * UMich sentiment survey peaked in July and has fallen since, so it’s possible things actually were relatively great in Q3 but have gotten meaningfully worse. * Consumer loans are at a record high, up over 10% this year, and up nearly 25% since 2019. So it’s possible a lot of the growth is fueled by debt and people are having an “oh crap” moment now. * Maybe the fed overdid it with hikes and everything is breaking. Delinquency rates on consumer loans / auto loans / credit cards (but not mortgages) are at the highest level since the early 2010s. While not historically high, the trajectory is a rocketship up right now. Usually downturns start with loan distress first, then consumer spending falls second, then unemployment rises third. The inflation rate looks great right now, but if it moves down toward 1% or below we’ll start hearing “uh oh, we overdid it” stories. * This is one CNN poll, and no need to put much stock in it. I suspect it may be a combination of all four.

-

Lorain County: Development and News

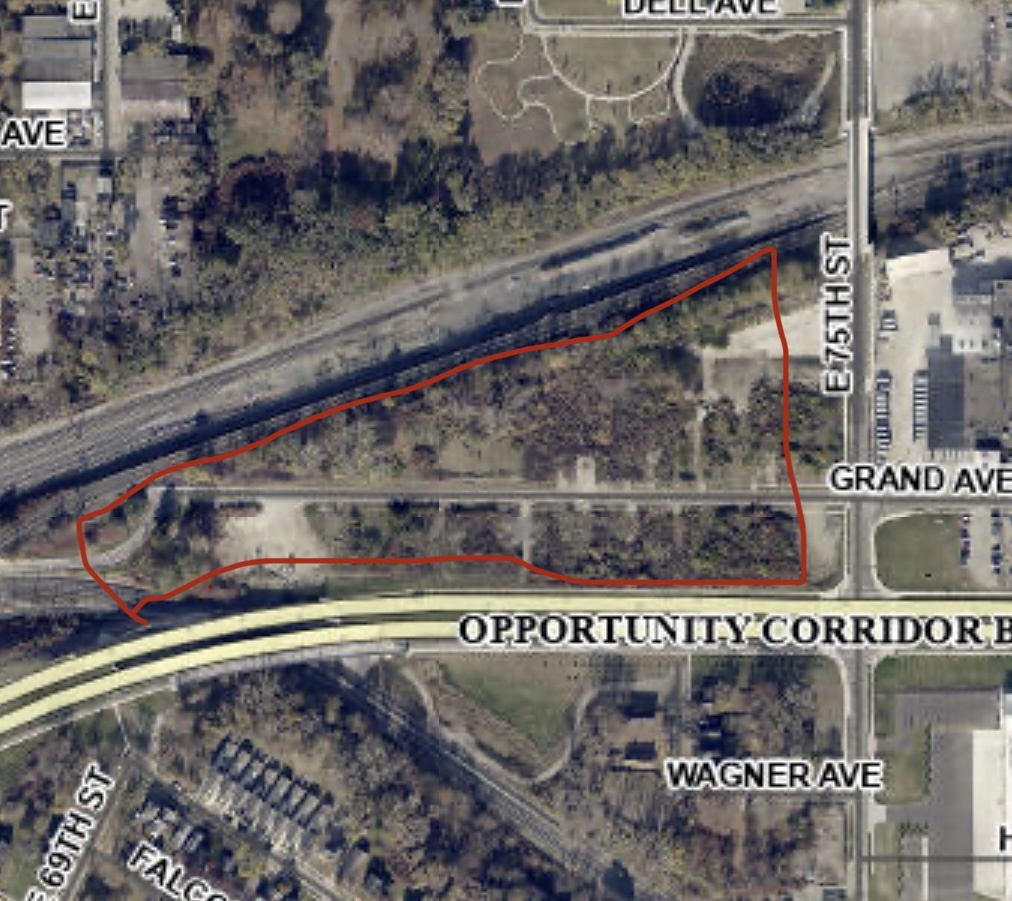

LlamaLawyer replied to buildingcincinnati's post in a topic in Northeast Ohio Projects & ConstructionGLB should go right here. Looks like it’s all city-owned land. About 11 acres. Right next to a huge cold-storage facility. Somebody with connections in the city wanna push for this?

-

Lorain County: Development and News

LlamaLawyer replied to buildingcincinnati's post in a topic in Northeast Ohio Projects & ConstructionOC location would jive well with a bunch of other food stuff that’s around there already.

-

Cleveland: Cleveland-Cliffs

The board has duties to the shareholders. They're supposed to put the interests of the shareholders first. If they rejected an obviously better offer for a much lower one, they could be sued. At the end of the day, it's the investors' money; it doesn't belong to the employees or the customers. It's by design that the corporate system works this way--warts and all. USS, like most publicly traded companies, is mostly owned by index fund managers like Blackrock, Vanguard, etc. So it's somebody's retirement money. It's good for Cliffs though. They basically just bid up their competitors by a lot. Nippon Steel has about a $21 billion market cap (3T Yen). I.e., their market cap is less than 2X what they're paying for US Steel. Nippon is down about 2% this week. I'm not sure how they're financing the purchase, but they could end up very leveraged. If so, Cliffs could have some good opportunities to pick off individual pieces of what was U.S. Steel.

-

Cleveland: Downtown: Gateway Megaproject

I'd also be cool with *not* building the Great Value Burj Khalifa here in Cleveland. Last time I checked there's not exactly a shortage of buildable urban land. How about a nice, normal ballpark village of walkable and mixed-use midrise buildings.

-

Cleveland: Downtown: Cleveland-Cliffs HQ

NBC says $14.9 billion, but y'know what's $800 million between friends. Just wanna point out this is DOUBLE Cliffs's offer. Actually, the $15B offer is 50% higher than Cliffs's market cap. FWIW, Cliffs' stock is up almost 10% on the news. Once this closes, Cliffs is THE American steel producer.

-

Cleveland: Cleveland-Cliffs

I believe USW can only delay and not ultimately reject a proposed sale. That being said, the nature of deals is the longer they delay the more likely they are to fall through. I would strongly suspect that Cliffs ultimately gets the deal unless the union changes its mind (doubtful) or someone else really outbids Cliffs.

-

Cleveland: General Business & Economic News

https://www.cleveland.com/metro/2023/12/short-term-pain-long-term-gain-cleveland-chips-away-at-social-safety-net-in-pursuit-of-revitalized-city.html I'm quite annoyed by this article. We're taking money from the county's general fund and giving it to the city's general fund, and that's somehow a win for big business and a problem for the least of these?

-

Cleveland Heights: Development and News

Trader Joe's would be awesome. It's a little disappointing to learn they were a real possibility but probably won't pan out. Glad it's being filled at least.

-

Cleveland: Cleveland Clinic News & Info

Unrelated: https://newsroom.clevelandclinic.org/2023/12/05/cleveland-clinic-founding-member-of-ai-alliance-an-international-community-of-leading-technology-developers-researchers-and-adopters/ (( Alternate link: https://thealliance.ai/news )) This partnership is potentially a huge deal, and I'm glad to see the Clinic is in it. Looks like the Clinic is maybe the only healthcare partner in the world, unless the universities are trying to loop in their healthcare facilities too. So in theory if Meta or IBM or Intel or HuggingFace want to test out some new healthcare AI model, they're pitching it the Cleveland Clinic first.

-

Cleveland: Cleveland Clinic News & Info

Also the Clinic got that huge donation from UAE earlier this year, so maybe they feel like they need to show up to say thank you a couple more times.

-

Cleveland: Cleveland Clinic News & Info

@KJP Do you think it isn't related to COP28?

-

Ohio Marijuana News

https://www.marijuanamoment.net/ohio-senate-committee-advances-bill-to-eliminate-marijuana-home-grow-reduce-possession-limits-and-raise-taxes-days-before-legalization-takes-effect/ Okay, I'm officially pissed. I've repeatedly maintained that there was no way the legislature would substantially gut Issue 2. They couldn't be that stupid. Well it turns out they are that stupid. They want to ban homegrow and they want to set THC caps which would prohibit the recreational sale of many products that are currently sold to medical card holders in Ohio. These are not "tweaks." These are not wonky tax adjustments. These are obvious restrictions that people who voted for Issue 2 will actually notice. I'm still holding out some decent hope that the bill will get watered down before passing.

-

Cleveland: General Business & Economic News

Y’know, the county as a whole isn’t growing either (at least not till recently). Downtown Cleveland and University Circle are growing as fast or faster than ANYWHERE else in the county. Cleveland continues to lose population mostly as a result of black-flight from relatively bad areas of the city to suburbs. But that will slow and stop eventually. Most importantly, it’s not a zero-sum game. Actually the success of the suburbs is good for downtown and vice versa. I don’t think we have to be either so fixated on downtown or so cynical about downtown that a business moving from one suburb to another is somehow a massive black mark for Cleveland.

-

Cleveland: Fairfax: Canon Facilities

Just wanna point out that the U.S. Ambassador to Japan and Japanese Ambassador to U.S. both being there signifies how this is a pretty big deal.

-

Cleveland: Hough: Development and News

Oh my gosh, I adore this proposal. So hear me out—THIS, but what if we build it on every single vacant block on the east side.

-

CLEVELAND UrbanOhio Meet Up - Fri Dec 8 Holiday Happy Hour - BrewDog - 1956 Carter Rd

Y'know what, I think I may be able to make it to this one. I'll circle back early next week.

-

Cleveland: General Business & Economic News

Oct. BLS numbers dropped and they're pretty good. Supposedly unemployment is 3.1%, the lowest unemployment rate since the late 90s. https://www.bls.gov/regions/midwest/oh_cleveland_msa.htm Overall job growth is still a measly 1.5% yoy, but some specific sectors look really good. Eds and Meds continues its rocket-ship ride, up 6.4% yoy. Also mining, logging, and construction is supposedly up 10.1% (!!!) yoy. Not sure what happened there.