Everything posted by LlamaLawyer

-

Cleveland: Random Development and News

LOL talk about cosmic justice. Roundstone blows up the Lakewood project by backing out in favor of a more car-focused and exurban location. And now the Rocky River NIMBYs are threatening to blow up their project. BUT it gets better because (although you have classic traffic, and similar concerns) what some Rocky River residents want instead of the Roundstone HQ is a mixed use development similar to the one in Lakewood that Roundstone spurned. https://www.crainscleveland.com/real-estate/planned-roundstone-insurance-hq-panned-rocky-river

-

Miscellaneous Ohio Political News

Anyone who has contacts in the Ohio democratic party machine needs to be helping them out and bugging them about what they will do about this. Sadly, the Ohio democratic party has been pretty inept in recent years. Even on an August ballot, this measure should be very defeatable. But we need to mobilize voters.

-

Cleveland Heights: Development and News

Wait a minute. We’ll have to park in the GARAGE?! *clutches pearls* /s Seriously though, what great news! It still feels surreal that this project is actually happening after all the obstacles.

-

Cleveland Heights: Development and News

It is in Cleveland Heights. I think there's a miscommunication here. It’s being taken over by the group that owns Red Steakhouse, but according to all the reporting I’ve seen, they’re going to keep it mostly the same as before. To this random painter on reddit “owned by Red’s Steakhouse” probably equates to “will be a steakhouse.” But I don’t think that’s accurate. see: https://clevelandmagazine.com/food-drink/articles/though-construction-is-delayed-nighttown-offers-sneak-peek-to-menu

-

Cleveland: General Business & Economic News

https://www.bls.gov/regions/midwest/oh_cleveland_msa.htm March BLS data is out. Overall fine, but not exciting. A couple specific sectors look GREAT though. In particular, "Eds and Meds" (aka education and health services) is up 5.3% YoY. If THAT keeps up, I'll start to get pretty excited.

-

US Economy: News & Discussion

The 1800s had a gold standard. Not to be one of those people (I will not argue for the gold standard, lol), but the fiat inflationary environment is totally different from the gold-backed inflationary monetary environment. It's easier (from a self control standpoint) for a government to limit inflation when it can't just print money. With a fiat currency, the temptation to print a little more than you should is everpresent. There are some things happening in the monetary pipelines that I think have completely unpredictable results. You can see it in some very weird inversions and absurd interest rate volatility. There's volatility because the market can't figure out what's going on. The 1 month t-bill is currently more than 1% below the federal funds rate and reverse repo rate, which means banks are willing to invest money in treasury bills and accept a rate of return that's a full percentage point lower than the rate they could get by just sticking the cash with the fed overnight. This makes as much sense as going to the grocery store and finding that four eggs and six eggs are the same price. These kinds of imbalances are problematic for two reasons. First, they make it impossible for banks and large companies to make intelligent decisions, which leads to excessive conservatism in some instances and to bad mistakes in others. Second, these imbalances signal something is really screwed up out in the monetary system. On the real-world side (as opposed to the monetary side), you can see from layoff reports that the real economy is starting to get screwed up. It's going to take a while before we see those impact in BLS numbers, which are lagging and have weird adjustments that sometimes mask layoffs. Other than Hyland, I haven't heard of big layoffs around here, and I'm sort of holding my breath hoping that we get through whatever is coming without major economic distress locally. The silver lining of this region's stagnation for the last 15 years is that we mostly missed out on the zero-percent-interest funding orgy that absolutely DUMPED cash into San Francisco, New York, Austin, and some others. That's a really nasty house of cards to fall, and, God willing, the fact that we missed out on most of that money means we'll also miss out on most of the bubble popping.

-

Cleveland: Downtown: Huntington Bank Field

So wait. Renovation of the stadium in its current location, in a way that will lead to the construction of a land-bridge and development of the waterfront is on the table. And the renovation would cost $1 billion. But the Haslams want to build a new stadium somewhere else and it could cost $3 Billion. If those are actually the options, I applaud Bibb for pushing to keep it where it is. $2 billion is so much money. The entire ARPA fund Cleveland got was $450 million. So we're talking about saving 4 ARPAs worth of money by keeping the stadium where it is. That seems like a no-brainer to me. The only real downside is the lack of a dome which means the stadium will continue to get used about 13 times a year instead of, say, 20 times a year like a domed stadium would. And it means Haslam doesn't get his one superbowl that he might not get anyway.

-

Ohio: General Business & Economic News

Correct. The trend is still interesting if it continues.

-

Ohio: General Business & Economic News

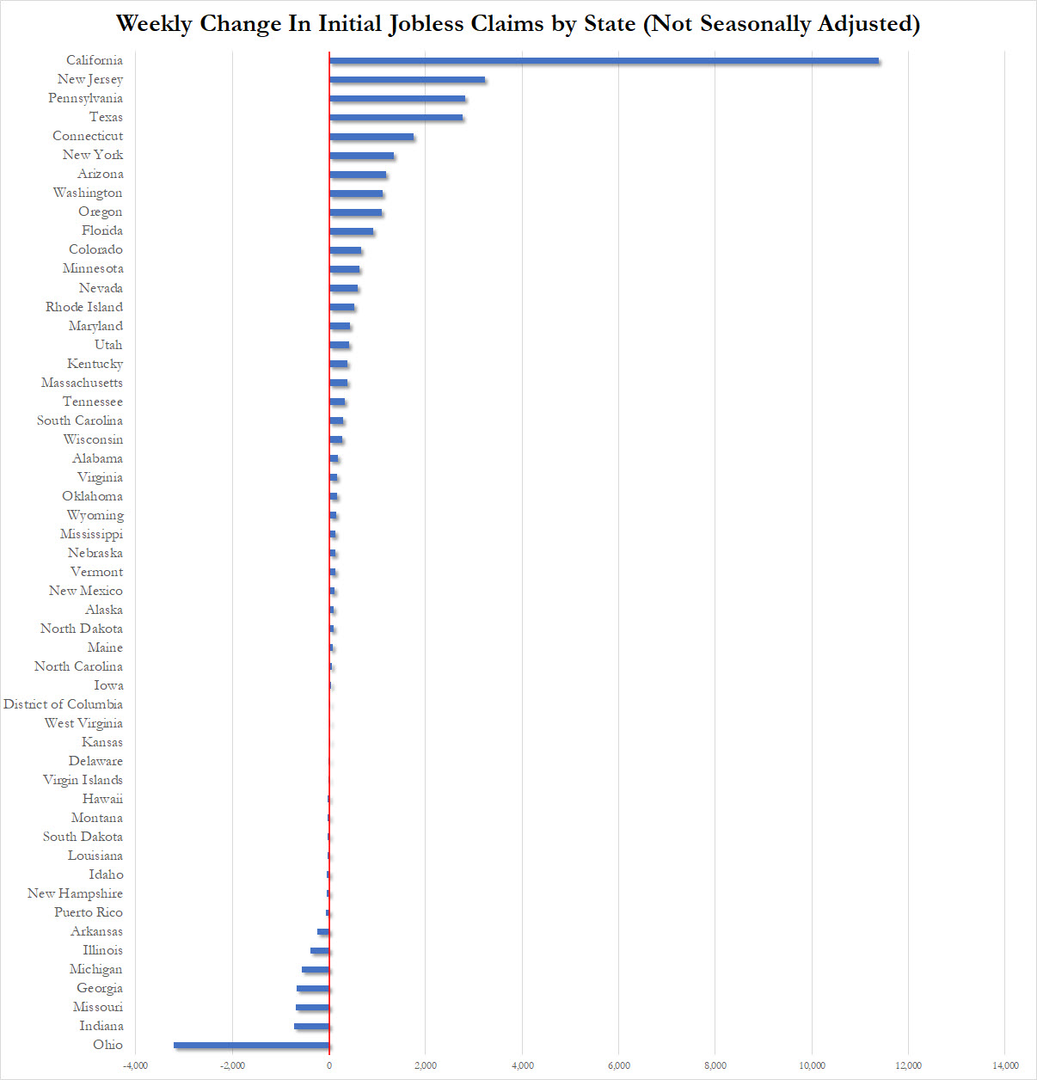

Obviously one week of data may be just noise. It would be important to watch trends. So I take this with many grains of salt. Also fewer jobless claims is not always good, since it could indicate labor force dropout rather than hiring strength. But with all those disclaimers, if I could pick any position to be on the chart, I'd certainly pick the Ohio end and not the California end.

-

Cleveland: Downtown: Justice Center Complex Replacement

At a CMBA event yesterday Judge Sheehan (the administrative judge for Common Pleas) said they still don't know what they're doing re the justice center and jail and that they haven't made a firm decision about remodeling vs. new location and the judges are waiting on Ronayne's administration to get fully up and running so they can work with him. He specifically mentioned the above Plain Dealer article. He didn't specifically refute it, but he reiterated nothing is decided. Now, Judge Sheehan has every incentive to give vague answers about the status. He is cautious enough by disposition that I would expect him to imply everything is up in the air even if it's 95% decided. So I wouldn't assume any of the above reporting is inaccurate based on his statements. Still thought it was worth mentioning.

-

Ohio: General Business & Economic News

Jobless claims fell sharply in Ohio last week-- more than any other state. In most states they rose. (Chart courtesy of @zerohedge on twitter).

-

Housing Market & Trends

Wow, I've never seen such flattering photography of a house in such terrible condition!

-

Cleveland: Downtown Office Buildings Updates

We're probably going to experience some reversion to the mean where work-from-home declines. But t's also hard for me to imagine we'll ever get back to the pre-pandemic status quo. More problematic though, I just don't think we've felt the full impact of the work-from-home switches that already occurred. Most of these office leases are 5 to 7 years, which means it probably won't be until the late 2020s that everyone who is going to downsize has had a chance to do so. I'm sure a lot of tenants renewed in early 2021 and are starting to wish they didn't. But I think Cleveland has some advantages here. We have a relatively tiny tech workforce. And tech is the industry that seems to be most severely impacted by WFH. As some evidence for this, our vacancy rate is currently lower than the epic boomtowns of Austin and San Francisco, and I expect that gap may widen. Additionally, we're fairly experienced here in office to residential conversions. So when the negative trends continue, I think we may be a little more ready to deal with it in a positive way than some other places.

-

Cleveland: Population Trends

Unrelated to the above discussion-- Yesterday I indulged my occasional hobby of checking who bought a house recently in Cleveland Heights using Zillow and Myplace Cuyahoga. Of the reasonably move-in ready houses (i.e. purchase price above $170,000 or so) every single one was purchased by a real person, not an investment LLC. The purchasers appeared to be roughly 2/3 folks who were from the area and 1/3 folks who were from elsewhere. The cheaper dilapidated houses, on the other hand, were mostly being bought up by LLCs. This to me suggests a very healthy housing market, as you have investors who are buying houses to fix them at the low end, but at the high end the houses are being bought by people who plan to live in them, not by speculators. Also, the recent Redfin migration estimates look pretty good, with inflows exceeding outflows. https://www.redfin.com/city/4145/OH/Cleveland/housing-market Some times I feel so much optimism about this city. It's taken the metro about 20 years to climb back to where it was in the year 2000 economically. But the outflows seem much more stabilized now. All we need is a few more big players to invest and create new jobs here, and you'll start getting the virtuous cycles that will make this place what it deserves to be.

-

Cleveland: Population Trends

It's not really misleading though. @KJPis comparing those neighborhoods to suburbs. Each of the suburbs also has large areas that aren't built up at all (e.g. vacant, parks) or that are dedicated to non-residential uses (e.g. Severance Town Center in Cleveland Heights). Additionally, the fact that areas like the Scranton Peninsula aren't built up actually does make each area less dense. I strongly suspect the rest of Tremont would have noticeable more pedestrian and vehicle traffic if the Scranton Peninsula were fully built up. Also, Wendy Park and Whiskey Island together probably make up 15-20% of Ohio City. Take them out, and you still have a population density comparable to Cleveland Heights.

-

Cleveland: Midtown: Development and News

Does anybody have a clue about the status of the long-languishing Warner & Swasey project, since it finally got state tax credits awarded last December?

-

Suburban Cleveland: Development and News

LlamaLawyer replied to buildingcincinnati's post in a topic in Northeast Ohio Projects & ConstructionI’m guessing there’s some tax benefit.

-

State of Ohio Hates Its Big Cities

To my point above, if you look at BLS data, Columbus actually had basically zero job growth during the 2000s, even before the GFC. Columbus has since recovered in a way other Ohio cities haven't. But all of Ohio (even Columbus) had basically a lost decade from 2000-2010. This was probably a result of manufacturing offshoring, but we were hit harder than some other heavy manufacturing states like PA were. EDIT: And just to more directly address your point, it's not like Ohio is the second circle of hell and we're all being tortured by demons or something. But that doesn't change the fact that the state has experienced no job growth since 2000. Let that sink in. None. I believe it's one of only three states to have such an honor, the other two being Michigan and West Virginia. Relative to other places, we're not doing well.

-

State of Ohio Hates Its Big Cities

While much of the Republican legislature does hate the big cities in Ohio, I think the brain drain and population drain has some more deeply rooted causes. Let's look at some charts of total nonfarm employment. It looks like something went wrong right around 1999 and the entire state has been fighting for the last 25 years to recover, which it almost did before covid and likely finally will in the next few years. Still, we will have had an essentially 30-year period with zero job growth. The same problem is present in an aggravated form in Michigan. Illinois seems to have had the same problem Ohio and Michigan did, but it recovered a little better. And Pennsylvania experienced a slowing of growth starting in 1999 but managed to maintain growth. Texas and Tennessee are like a totally different universe. So I think the brain drain and population drain may actually be the cause of the deepening regressive politics here, rather than the other way around.

-

Another Dumb-a$$ List / Ranking of Cities

I spent a few days in Los Angeles a couple weeks ago, and it's mind boggling to me how we have a higher crime rate than they do. L.A. is a cool town, but holy cow, there's lots of sketchy places there way beyond anything we have here in Cleveland.

-

Cleveland: Downtown: The Centennial (925 Euclid Redevelopment)

In fairness to Millennia, they were granted the TMUD in early 2022, right at the beginning of the most dramatic interest rate hike in human history. So I'm willing to give them the benefit of the doubt that maybe their original financing plan blew up unexpectedly.

-

Cleveland: Downtown: The Centennial (925 Euclid Redevelopment)

Millennia is one of the big boys, so I'm going to assume they have some good reason for the additional office space. The reduction in affordable housing is obviously disappointing, but clearly they tried, so can't really fault them. 410 units is still huge. I think though, that this will be a good example to bring up to people in the future who criticize a lack of affordable housing being built. It's really hard to build anything that's not market rate. There's a reason the market rate is the market rate. It's because that's the rate at which you can finance and build with an an acceptable rate of return on capital. Millennia has secured every credit and incentive they can possibly get their hands on, and they STILL couldn't get financing for the mix of affordable-rate units they wanted.

-

Greater Cleveland RTA News & Discussion

Great reporting, @KJP. I don't think I realized the full implications of moving to one type of railcar vs. two. Having a green line/blue line route to the airport could be extremely valuable. It also seems like long-term we could get some tram extensions on smaller roads that could plug into the red line (I'm thinking Detroit Ave. west of the West-Cudell station; W.25/Pearl Rd. south of the W. 25 station; maybe even Cedar Rd. east of the 105 station or Mayfield Rd. east of the Little Italy station). Some of those trams could be super useful because even if they were going 20-25 mph with stop lights for the whole tram stretch, they could speed up to 50 when they hit the existing lines. That would lead to some pretty good travel times. Speaking of which, I'm curious if anyone knows the background of why Cleveland has no trams at all? It seems like most other midsized cities with rail rely pretty heavily on tram lines. EDIT: and just to be clear, I'm excluding green and blue lines here because they don't really share the road with the cars; they've got these huge barriers and are placed in the median. So in my mind that's not a true tram.

-

Cleveland: Cleveland Clinic News & Info

Maybe I'm biased, but Cleveland for hub 2 and Boston for hub 3 seems like a no-brainer here.

-

Cleveland: Cleveland Clinic News & Info

The potential is even higher than that, since the hope is to do in minutes or hours computations that would take standard computers incomprehensibly long amounts of time like billions or trillions of years. I.e. quantum computers will be able to do things that conventional computers cannot do. In a more hands-on sense quantum and conventional computers are totally different, since quantum is using new computational algorithms that are different from the ones we've been using for 80 years with standard computing. But the device that's installed at the Clinic just isn't all that big. No current quantum computer is. And so there's probably no problem it can solve faster than some random super computer in the IBM cloud. But because the computational process it uses is so different, this is a golden opportunity for programmers associated with the clinic and local med tech really to cut their teeth on the general concepts associated with quantum programming. The institutional expertise that will be gained could be very useful in 5-10 years when we have machines that actually can do things no conventional computer can. Also, keep in mind we're just a few years into this IBM-Clinic partnership. Expect this device to get upgraded a couple times before the decade is out.