Everything posted by LlamaLawyer

-

Cleveland: Midtown: Development and News

Right, by making certain roads (e.g. Carnegie, Chester) feel more auto-focused, you take traffic away from pedestrian/bike/transit corridors like Euclid. If Euclid, Carnegie, and Chester all looked the same, Euclid would have a lot more auto traffic. Because Carnegie and Chester are so much faster for cars, Euclid gets way less traffic, which makes it more bus and pedestrian friendly. So, whether or not you love the setbacks, I really appreciate the fact that they're on Chester, not Euclid.

-

Cleveland: Midtown: Development and News

I don't personally care about the frontage that much. There are twelve zillion more vacant lots on Carnegie where we can push to have better frontage. I think it's self defeating to get too picky before the street really has its momentum built up.

-

Ohio: General Business & Economic News

It's funny because I've driven that stretch (CLE to 270) probably hundreds of times. The conversation above has been as if there are some parts of 71 that aren't three lanes on that stretch, so that was the context of my answer. But...As I think about it, I can't think of any stretch of road all the way from Cleveland to Columbus that isn't three lanes.

-

Ohio: General Business & Economic News

Just because we’re urbanists doesn’t mean we have to hate intercity and interstate highways lol. I totally agree with you that 71 should be 3 lanes basically the whole way. Every few minutes you can shave off the Columbus-Cleveland trip adds productivity and therefore GDP to both metros.

-

The Future of America and Its Cities

Cleveland being south of Rome is my favorite fact for the haters.

-

Cleveland: KeyCorp / KeyBank

As others have said above, these contracts were probably created a year ago when Key was trading at $27. The only person who would buy Key at $30 right now is Elon Musk. (To be clear, that's a joke, not a prediction.) A Jan 23 $30 Call which is worth next to nothing now is worth exactly nothing if Key gets bought out for $30 or less per share. There are also bigger option buys at Jan 23 $17 Put, $15 Put, and even $12 Put. It's probably not insider trading. Probably just some schmuck from WallStreetBets who put $2000 in his Robinhood account and only has $200 in it now. In any event, I suppose it's possible Key would get bought out, but the option chain has nothing to do with that possibility.

-

Cleveland: General Business & Economic News

-

Cleveland: General Business & Economic News

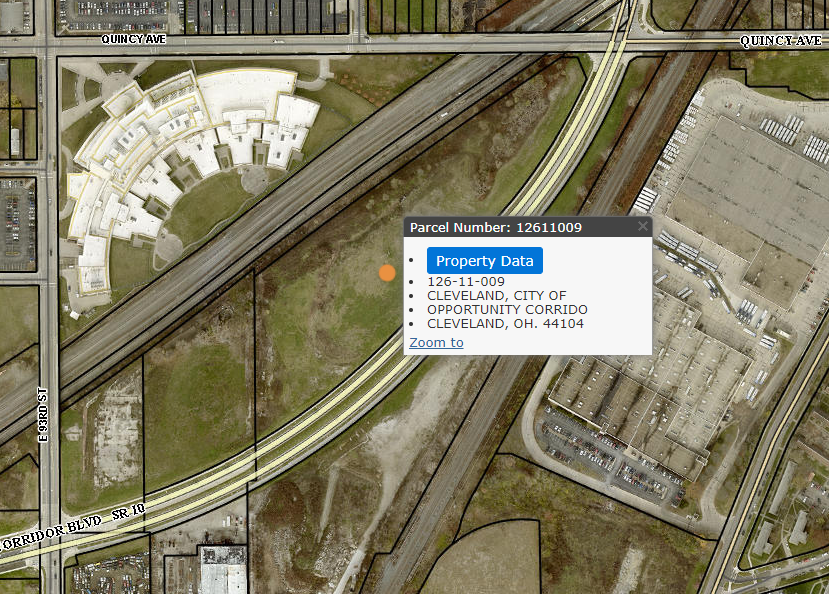

No doubt Bibb will work at this. Hopefully he's effective. Does anyone know how many parcels along Opportunity Corridor the city owns outright and where they are? Seems like a good opportunity to sell a parcel for a dollar to Canon.

-

Cleveland: Ohio City: Bridgeworks Development

The Cuyahoga County projects that beat it out are also located in downtown and University Circle--two jobs hubs. Ohio City is not a jobs hub.

-

Cleveland: Downtown: Tower at Erieview & Galleria Renovation

TMUD winner.

-

Cleveland: University Circle: Circle Square

Circle Square won. NGL, I'm disappointed in Bridgeworks, but I think this project may be more important for the city long-term.

-

Cleveland: General Business & Economic News

Where can one find this data? Does it come from household survey? If not, how is the data generated?

-

Cleveland: University Circle: Cleveland Clinic Developments

It's always sad when these old buildings can't be preserved. But I'll take the jobs over the buildings.

-

Cleveland: Downtown Office Buildings Updates

Okay. And Cross Country is moving downtown. These are just anecdotes. https://www.avisonyoung.us/documents/91132/100685724/Cleveland+Quarterly+Office+Market+Report+-+Q2+2022_final_v2.pdf/6fde63aa-b737-d4aa-c2de-7c10e7ce0f80?t=1659539558011 ^According to this report, as of Q2 2022, downtown vacancy is lower than suburban and suburban net absorption is worse than downtown according to the above report. https://www.us.jll.com/content/dam/jll-com/documents/pdf/research/americas/us/q3-2022-office-insights/jll-us-office-insight-q3-2022-cleveland.pdf ^This report shows higher vacancy downtown (unclear the reason for the discrepancy), but it still shows absorption rate is better downtown than in the suburbs. https://www.svnsummitcommercial.com/market-trends/cleveland office market report pdf.pdf ^This one agrees that suburban vacancy is lower but states that CBD is doing impressively well. It doesn't list net absorption, but says "the largest recent leases inked throughout the market have been for Class A space in the CBD. Should rising demand for higher-tier floorplans accelerate in the near term, existing properties with availabilities stand to benefit." So based on the above, our optimism should definitely be tempered. You won't hear me saying "DOWNtoWn growth IS GOing to crUsh ThE SubURban OffICe marKET!! beaChwOOd Is TOast!!" But I don't think the data bears out "losing a staggering amount of jobs and taxes to [the] surburbs." If you have contrary data that suggests downtown office market really is toast, and the suburbs are going to eat downtown's lunch, I'm interested to hear it.

-

CLEVELAND UrbanOhio 2022 Happy Hour Meet Up - Tuesday, Dec. 20 at Masthead Brewery (1261 Superior Ave)

I'm not sure I can make it in any event, so don't build a schedule totally around me, but 19th and 20th are out; 21 and 22 are both possibilities.

-

Cleveland: Downtown Office Buildings Updates

The office jobs aren't going from downtown to the suburbs; they're going from downtown to the dining room table. Suburbs are having the same problems with leasing, which will probably benefit downtown more than the suburbs since one advantage of suburbs is cost, and prices would be going down across the board, thereby lessening the cost advantage to suburbs.

-

Cleveland: Downtown: Tower City / Riverview Development

So I'm clear, are they actually asking for public financing for the apartment buildings etc., or is it for "infrastructure improvements" such as stabilization work that will allow this all to be built. I know it's a semantic difference, but the latter can probably come from infrastructure bill money or ARPA money. And, believe it or not, the city has so much ARPA money it still hasn't figured out how to use it all yet.

-

Cleveland: Downtown: Tower City / Riverview Development

I get the dampened enthusiasm @TBideonand others have based on the tendency these sorts of visions have to...well...just not happen. But I just do not get the design criticisms. The renderings are labelled "concept rendering," which means obviously more polishing will be done. The design and architectural vision is gorgeous and makes a lot of sense. If executed, this will create an incredible public space unlike anything else in the State of Ohio.

-

Housing Market & Trends

Wow, I'm way more optimistic than this. I actually think we're positioned pretty well. Our labor force is very healthcare centric, more than ever before. And healthcare is pretty recession-proof. There's also lots of looming onshoring that we're going to get some of. And we're decent off fiscally because the city and state both used covid funding to pay down debt. We also haven't had much time to anchor property tax expectations based on unrealistic home valuations, which some markets have. A housing market that goes up 5% then down 5% is not the same as one that goes up 25% then down 25%. All that being said hard to see us missing the bullet completely if there's a major global downturn.

-

Cleveland: General Business & Economic News

It will be installed sooner, but IBM's Osprey--its 433 qubit (qubits are the quantum equivalent of bits) state of art processor released this month--isn't useful. 433 qubits is enough to do amazing work in theory, but the qubit integrity IBM actually has is still too low, which means you can run an algorithm through the machine which would be impossible to run on a conventional supercomputer, but the results of algorithm would be so incredibly inaccurate that it's just noise. They compensate for this by having most of the qubits focused on correcting errors of other qubits. This way you can get an accurate result, but the complexity of algorithms is greatly reduced. In other words, the quantum computer to be installed at the Cleveland Clinic next year is not a useful machine for doing calculations, because it can't do anything that your macbook can't. What it IS is a useful training tool for the Clinic to start getting used to the design, infrastructure, and kinds of problems quantum computing can solve. That's why I say in five years, which is my uneducated guess on when IBM's quantum machines become able to do calculations that standard computers cannot. When that time comes, the Cleveland Clinic will be well positioned to jump right in with a minimal learning curve.

-

Housing Market & Trends

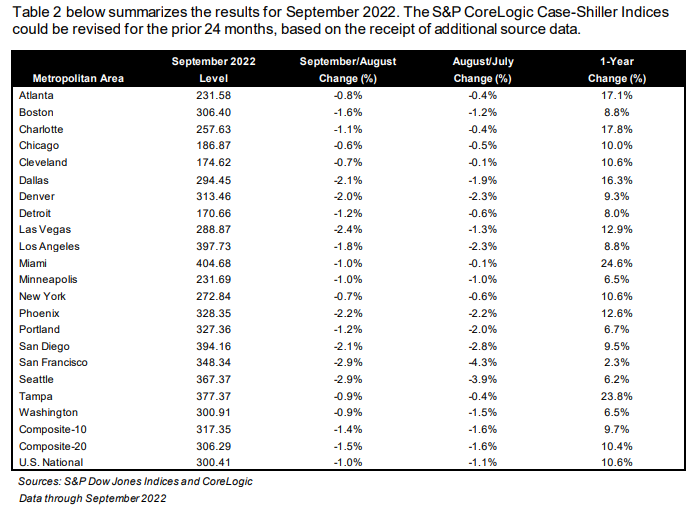

https://www.spglobal.com/spdji/en/documents/indexnews/announcements/20221129-1458251/1458251_cshomeprice-release-1129.pdf Here's the full report link. Cleveland and Chicago are technically off of their peaks, but just barely. What's interesting to me is the comparison to Detroit and Minneapolis, which are both plunging more steeply than Cleveland and Chicago. Here's the table (not seasonally adjusted): Hard for me to imagine we totally avoid a recession here, but you can see how much worse it's trending out west. San Francisco looks to be one month away from net negative 1-year change.

-

Cleveland: General Business & Economic News

And IBM--which could mean something in five years when their quantum computers are useful.

-

Cleveland: Downtown: New Police Headquarters

This location is the kind of cheap, elegant, and common sense solution that I couldn't imagine happening in the previous administration. I've got a feeling that the rigmarole about reevaluating the Jackson administration's plan due to the need for a "faster move-out" may have been coded language "The Bibb administration hated the plan from the start." I'm okay with that. Also, a police HQ in a historic mid-rise building immediately gives me warm and fuzzy Brooklyn Nine-Nine vibes. That's a plus. Renovating old buildings > Building new buildings* *usually

-

Cleveland: Detroit-Shoreway: Westinghouse Redevelopment

The warehouse part would be hard to use for much else because of the flat wide footprint. Seems like a great plan. Any idea if the mcpc warehouse will create new jobs?

-

Cleveland: General Business & Economic News

It’s the nicest office building in the county, so I would assume they’ll have a (relatively) easy time filling back up.